Avnet Surpasses Q3 Sales Estimates

Avnet’s Q3 CY2025 Performance

In the third quarter of calendar year 2025, electronic components distributor Avnet reported a notable increase in sales, reaching $5.90 billion, which represents a 5.3% year-over-year growth. The company also provided optimistic guidance for the next quarter, projecting revenue of $6 billion at the midpoint, which is 2.5% above analysts’ estimates. Additionally, Avnet's non-GAAP profit of $0.84 per share exceeded analysts' expectations by 4%.

Key Highlights from Avnet’s Q3 CY2025 Results

- Revenue: $5.90 billion compared to analyst estimates of $5.73 billion, reflecting a 5.3% year-on-year growth and a 3% beat.

- Adjusted EPS: $0.84 versus analyst estimates of $0.81, showing a 4% beat.

- Adjusted EBITDA: $168.6 million compared to analyst estimates of $171.6 million, resulting in a 2.9% margin and a 1.8% miss.

- Revenue Guidance for Q4 CY2025: $6 billion at the midpoint, exceeding analyst estimates of $5.85 billion.

- Adjusted EPS Guidance for Q4 CY2025: $0.95 at the midpoint, below analyst estimates of $1.02.

- Operating Margin: 2.4%, consistent with the same quarter last year.

- Free Cash Flow: -$169.2 million, down from $74.55 million in the same quarter last year.

- Market Capitalization: $4.11 billion.

Avnet CEO Phil Gallagher stated, “In the first quarter, our sales and earnings exceeded our expectations, led by double-digit year-over-year sales growth in Farnell and Asia.”

Company Overview

With over a century of history, Avnet (NASDAQ:AVT) has consistently adapted to technological changes. As a global electronic components distributor, it connects semiconductor manufacturers with businesses that require these components.

Revenue Growth

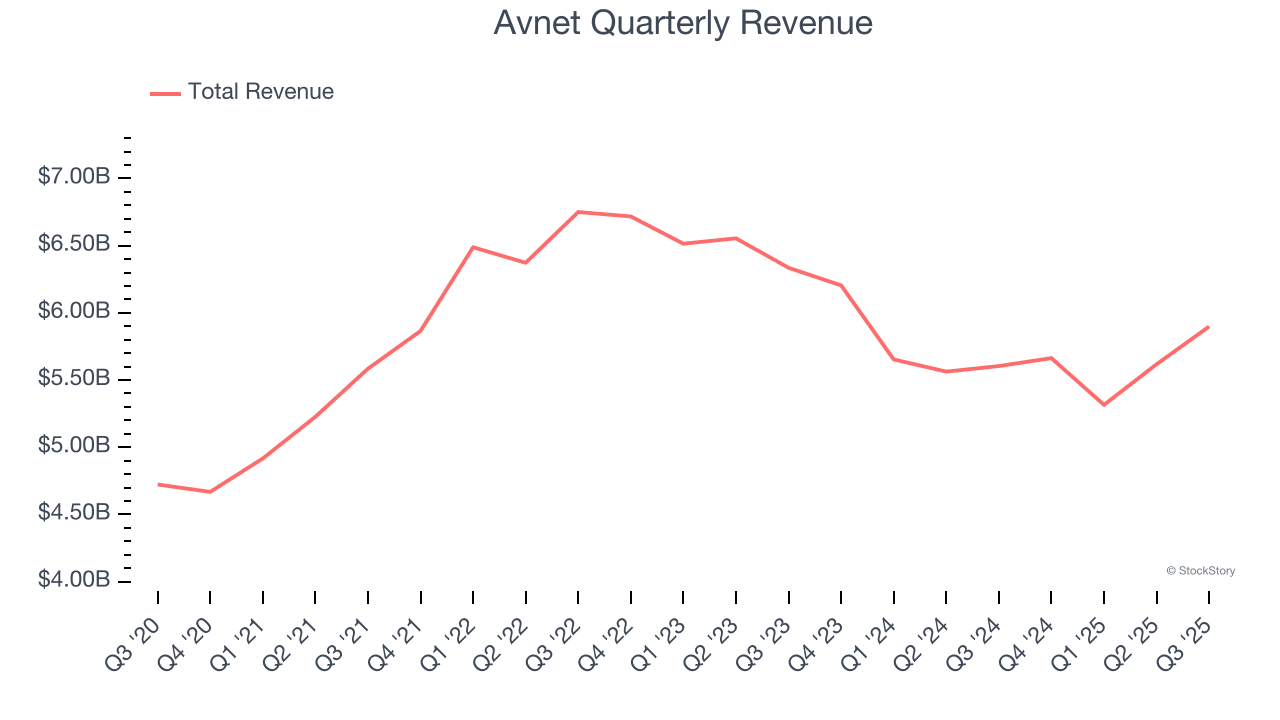

Examining a company’s long-term performance can provide insight into its quality. While short-term success is possible, top-performing companies typically exhibit sustained growth over years. With $22.5 billion in revenue over the past 12 months, Avnet is a significant player in the business services sector. Its scale provides economies of scale, allowing it to leverage fixed costs more effectively than smaller competitors and offer lower prices. However, maintaining high growth rates becomes challenging as the company captures a large portion of the addressable market.

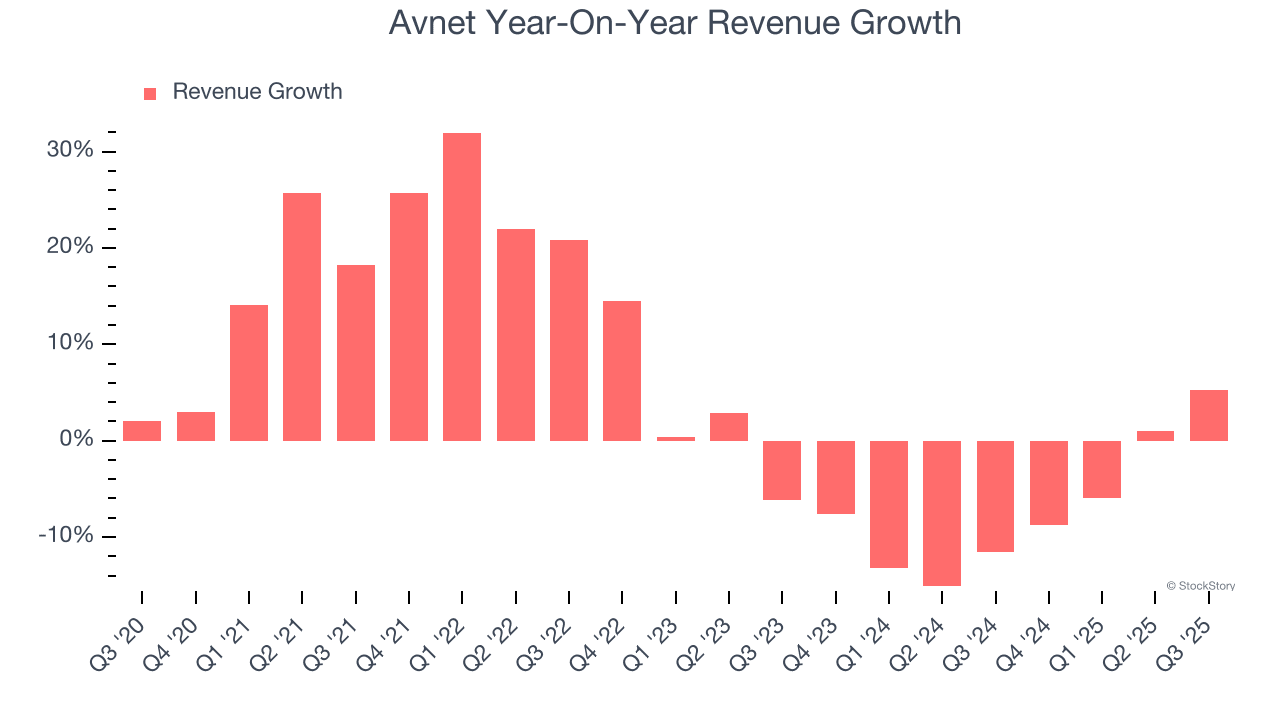

Over the last five years, Avnet’s sales grew at a modest 4.9% compounded annual growth rate. This suggests limited demand generation and presents a tough starting point for analysis.

Long-term growth is crucial, but within the business services sector, a half-decade historical view may overlook new innovations or demand cycles. Avnet’s performance shows it grew in the past but lost some gains over the last two years, with revenue declining by 7.2% annually.

This quarter, Avnet reported a 5.3% year-on-year revenue growth, surpassing Wall Street’s estimates by 3%. Management is currently guiding for a 5.9% year-on-year sales increase in the next quarter. Sell-side analysts expect revenue to grow 4.7% over the next 12 months, though this projection still falls below the sector average.

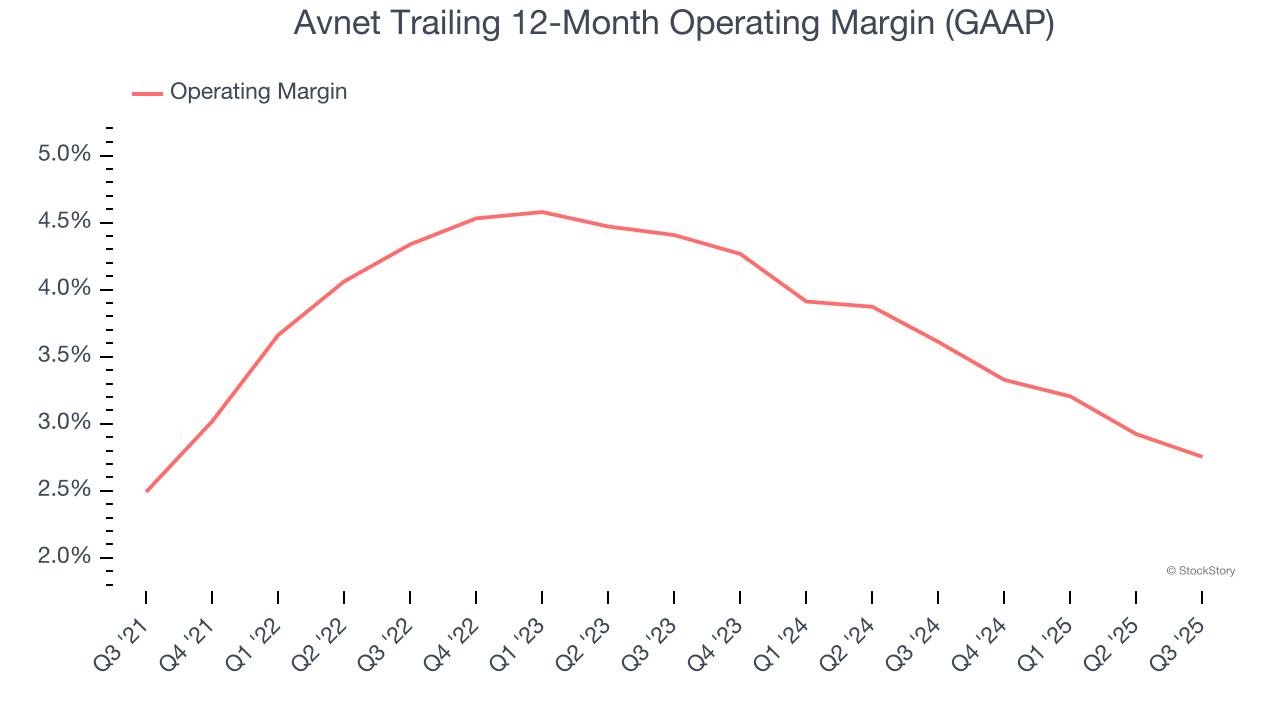

Operating Margin

Avnet’s operating margin has fluctuated slightly over the last 12 months but has remained relatively stable, averaging 3.6% over the last five years. This profitability was suboptimal for a business services company due to its cost structure.

Looking at the trend in profitability, Avnet’s operating margin has generally stayed the same over the last five years. This raises questions about the company’s expense base because its revenue growth should have allowed for better economies of scale and profitability.

This quarter, Avnet generated an operating margin of 2.4%, matching the same quarter last year. This indicates a relatively stable cost structure.

Earnings Per Share

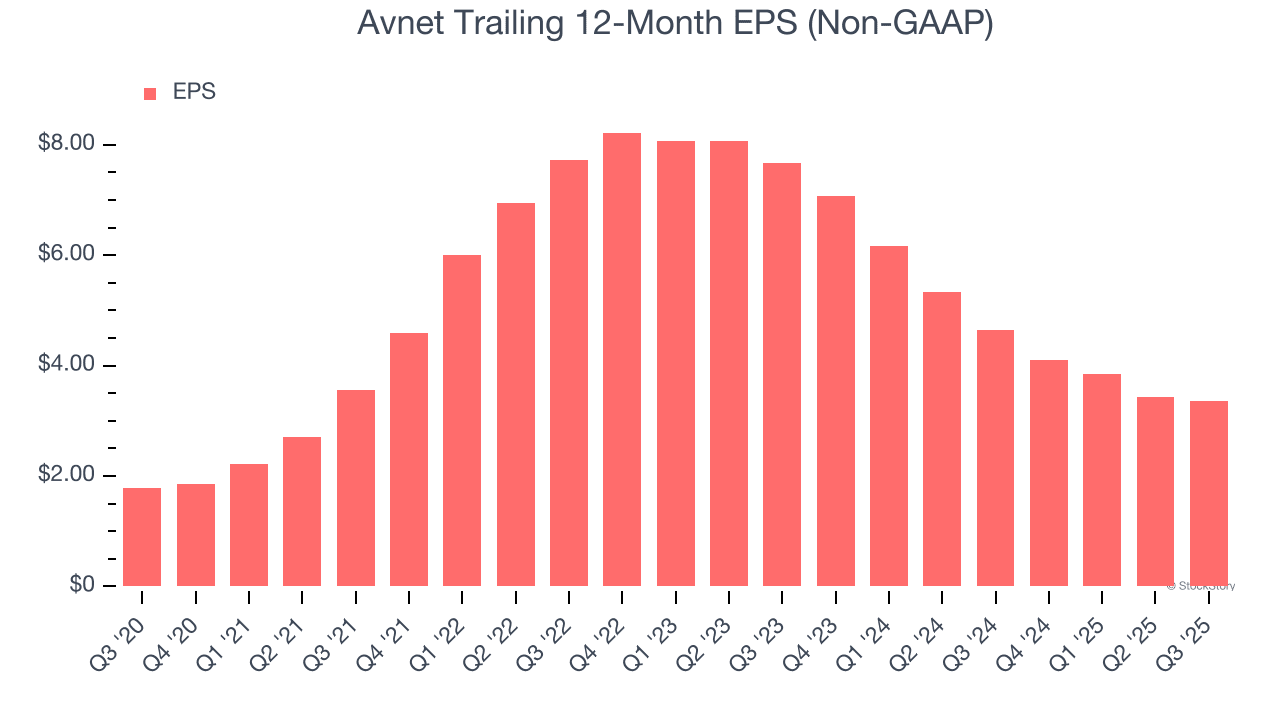

While revenue trends explain a company’s historical growth, the long-term change in earnings per share (EPS) reflects the profitability of that growth. For example, a company could inflate sales through excessive advertising and promotions.

Avnet’s EPS grew at a strong 13.5% compounded annual growth rate over the last five years, outpacing its 4.9% annualized revenue growth. This suggests the company became more profitable on a per-share basis as it expanded.

Like with revenue, we analyze EPS over a more recent period to gain insight into emerging themes or developments for the business. For Avnet, its two-year annual EPS decline of 33.8% marks a reversal from its previously healthy five-year trend. We hope Avnet can return to earnings growth in the future.

In Q3, Avnet reported adjusted EPS of $0.84, down from $0.92 in the same quarter last year. Despite the year-over-year decline, this print beat analysts’ estimates by 4%. Over the next 12 months, Wall Street expects Avnet’s full-year EPS of $3.36 to grow 55.8%.

Key Takeaways from Avnet’s Q3 Results

We were impressed by Avnet’s optimistic revenue guidance for the next quarter, which surpassed analysts’ expectations. We were also pleased with its revenue outperforming Wall Street’s estimates. However, its EPS guidance for the next quarter missed expectations. Overall, this result had several key positives. The market seemed to be hoping for more, and the stock traded down 3.9% to $48.61 immediately following the results.

So do we think Avnet is an attractive buy at the current price? The latest quarter does matter, but not nearly as much as longer-term fundamentals and valuation when deciding if the stock is a buy. We cover that in our actionable full research report, which you can read here, it’s free for active Edge members.

Post a Comment for "Avnet Surpasses Q3 Sales Estimates"

Post a Comment