Constellation Brands Plummets: Is Now the Time to Buy?

The Struggles of Constellation Brands

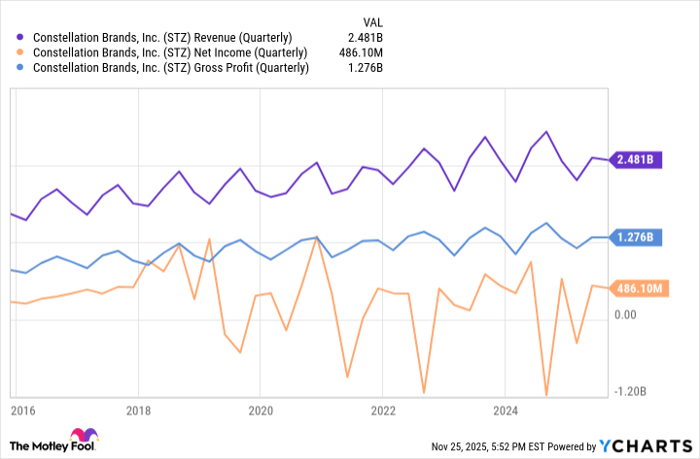

The recent performance of Constellation Brands has been challenging for its shareholders. The stock has experienced a significant decline, dropping more than 50% from its early 2024 peak and continuing to trend downward. This downturn is attributed to the end of the worst phase of the COVID-19 pandemic and the onset of an inflationary period, which have both impacted alcohol consumption. People are drinking less due to health concerns and financial constraints.

Despite these challenges, there are signs that the company's future may look more promising than its recent past. The current market sentiment might be overlooking the potential for a turnaround, making this a potentially attractive entry point for patient investors.

Understanding the Company

Constellation Brands is known for its popular beer brands such as Modelo and Corona, which contribute significantly to its revenue. The company also owns several smaller wine brands like Kim Crawford and Ruffino, as well as spirits such as High West whiskey and Mi Campo tequila.

In the last fiscal year, the company generated $10.2 billion in revenue, showing a slight increase from the previous year. However, this growth has not been consistent. Sales have declined by 10% through the six-month period ending in August, with gross and operating profits also experiencing similar declines. These figures are largely influenced by a difficult socioeconomic environment that has dampened consumer demand across the industry.

The Bullish Case for Constellation Brands

There are reasons to believe that 2025 could mark a turning point for Constellation Brands. The company is focusing on rebuilding a stronger business for what is expected to be a better business environment. One of the key changes involves divesting certain lower-priced wine brands. While wine is not a major revenue source, CEO Bill Newlands emphasized that concentrating on higher-growth segments aligns with the company's overall strategy and complements its higher-end beer portfolio.

Higher-end alcohol consumption has seen a modest increase despite overall declines, which bodes well for Constellation's beer brands. These brands remain accessible to most consumers while offering a premium product.

Operational Improvements

Operationally, Constellation Brands is taking steps to improve efficiency. The company aims to cut $200 million in unnecessary annual spending by the end of fiscal 2028. This move, combined with the company's focus on controlling controllables, suggests a commitment to long-term sustainability.

Additionally, there is potential for a cyclical rebound in the beer business driven by economic recovery. Veteran investors understand that consumer goods markets experience fluctuations, and turnarounds often occur without much warning.

A Balanced Investment Opportunity

While there is no guarantee that Constellation Brands shares will rebound immediately, the current valuation offers a compelling opportunity. With a forward-looking price-to-earnings ratio of less than 20, the risk has likely been mitigated. Although not the highest-growth prospect, it is certainly not the most dangerous investment in its sector.

Investing in Constellation Brands means supporting one of the highest-quality companies in an industry with proven long-term resilience. The current headwinds in the alcohol sector are temporary, and entering during these times can offer significant upside.

Analyst Perspectives

Analysts remain optimistic about Constellation Brands, with many recommending it as a buy. The consensus price target stands at $169, which is 28% above the current stock price. This suggests that the market is beginning to recognize the company's potential for recovery.

For those considering an investment, it's important to weigh the risks and opportunities carefully. While the stock has underperformed recently, the analyst community is becoming increasingly bullish. This shift in sentiment could signal a positive change in the company's trajectory.

In summary, Constellation Brands presents a unique opportunity for investors willing to look beyond the current challenges and recognize the potential for future growth.

Post a Comment for "Constellation Brands Plummets: Is Now the Time to Buy?"

Post a Comment