Cameco Stock: Should You Buy Now?

Cameco: A Key Player in the Nuclear Power Renaissance

Cameco is a leading supplier to the nuclear power industry, providing essential fuel for power plants and offering a wide range of services needed to build and operate reactors safely and efficiently. As the world increasingly turns to nuclear energy as a clean and reliable power source, Cameco has emerged as a key player in this growing sector. However, with its stock price soaring in recent years, investors are asking whether it's still a good time to invest in the company.

The Growing Demand for Nuclear Power

Nuclear power is experiencing a significant resurgence, driven largely by the technology sector’s need for stable and continuous electricity. Tech giants like Microsoft and Meta have entered into long-term agreements to secure power from existing or reactivated nuclear reactors. For instance, Microsoft signed a 20-year agreement with Constellation Energy for power from the Three Mile Island plant, which is expected to restart in 2028. Similarly, Meta secured a deal for the Clinton Clean Energy Center, effectively replacing government subsidies that were set to expire.

These developments highlight the increasing importance of nuclear energy in supporting the energy demands of data centers, which are crucial for AI and other high-tech operations. Unlike solar and wind energy, which are intermittent, nuclear power provides consistent baseload power—making it an attractive option for companies that rely on uninterrupted operations.

Why Nuclear Power Matters

Nuclear power is a clean energy source that does not emit greenhouse gases. This makes it a viable alternative to fossil fuels in the fight against climate change. However, its value extends beyond environmental concerns. Data centers, which require constant power, are particularly vulnerable to outages. Recent incidents, such as the overheating of a data center that disrupted CME Group's trading operations, underscore the critical need for reliable power sources.

The nuclear sector is expected to play a major role in meeting the projected 55% increase in energy demand between 2020 and 2040. This growing demand will likely translate into increased uranium consumption, benefiting companies like Cameco, which is one of the largest suppliers of uranium.

Cameco's Strategic Moves

In addition to its core uranium business, Cameco has made strategic moves to strengthen its position in the nuclear industry. It recently acquired half of Westinghouse, a major service provider to the nuclear power sector. This acquisition adds a more stable and less commodity-dependent revenue stream to Cameco's operations, further solidifying its market position.

Investor Sentiment and Valuation Concerns

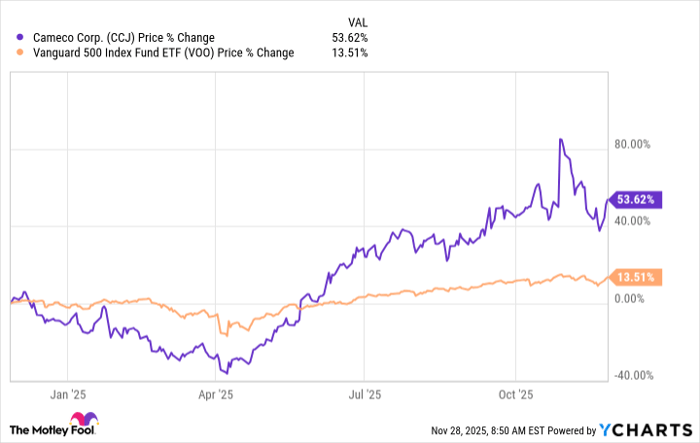

Investors have shown strong interest in Cameco, with its stock price rising significantly over the past few years. Over the past year, the stock has gained over 50%, compared to a roughly 13% increase in the S&P 500 index. Over five years, the stock has surged by more than 770%, far outpacing the broader market.

However, this rapid growth has led to a high valuation. Cameco's price-to-sales ratio is currently around 15.6, nearly double its five-year average. Its price-to-earnings ratio of 102 is also notably high, especially when compared to the S&P 500's P/E ratio of 28.5. These valuations suggest that investors have already priced in a lot of optimism about the company's future.

Caution Is Advised

While Cameco is a well-managed company with strong prospects, the current valuation raises concerns. Buying the stock at these levels requires a strong belief in the nuclear power renaissance. Even if the sector continues to grow, there is a risk that the stock could be overpriced for perfection. Any deviation from the best-case scenario could lead to a shift in investor sentiment.

Final Thoughts

For most investors, it may be wise to approach Cameco with caution. While the company has a compelling story and is positioned well in the nuclear energy market, the current stock price may not offer the best value. Before making an investment decision, it’s important to carefully evaluate the company's fundamentals and consider alternative opportunities.

Before you buy stock in Cameco, consider this:

The Motley Fool Stock Advisor analyst team just identified what they believe are the 10 best stocks for investors to buy now… and Cameco wasn’t one of them. The 10 stocks that made the cut could produce monster returns in the coming years.

Consider when Netflix made this list on December 17, 2004... if you invested $1,000 at the time of our recommendation, you’d have $588,530. Or when Nvidia made this list on April 15, 2005... if you invested $1,000 at the time of our recommendation, you’d have $1,102,885.

Now, it’s worth noting Stock Advisor's total average return is 1,012% — a market-crushing outperformance compared to 193% for the S&P 500. Don’t miss out on the latest top 10 list, available when you join Stock Advisor.

Post a Comment for "Cameco Stock: Should You Buy Now?"

Post a Comment